|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

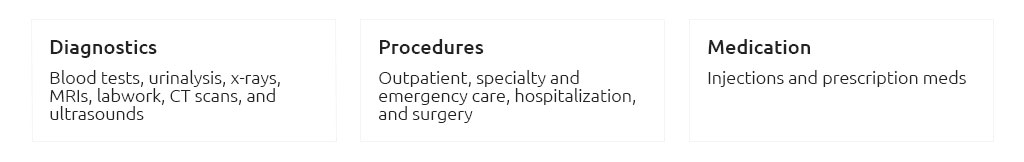

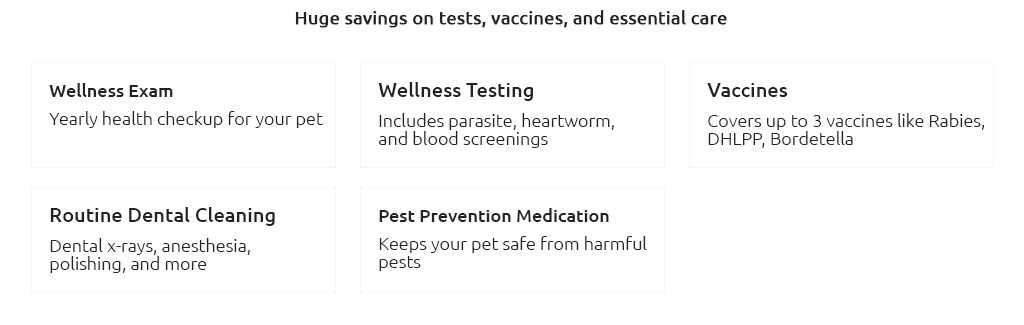

Understanding Dogs Health Insurance: What Every Pet Owner Needs to KnowAs a devoted pet owner, you undoubtedly strive to provide the best possible care for your furry friend. One topic that increasingly occupies the minds of dog owners is health insurance for dogs. This concept, although initially met with skepticism by some, has gained traction as more people recognize the potential benefits of insuring their pets. In this comprehensive guide, we'll explore the nuances of dogs health insurance, addressing frequently asked questions and offering practical advice to help you make an informed decision. Why Consider Health Insurance for Your Dog?First and foremost, veterinary care can be unexpectedly costly. A sudden illness or injury can result in significant expenses, and health insurance can mitigate these financial burdens. By investing in a policy, you're essentially safeguarding your pet's health and your wallet. What Does Dog Health Insurance Typically Cover?Most insurance policies cover a range of issues, from routine check-ups to emergencies. However, coverage varies widely between providers. Generally, you can expect insurance to cover:

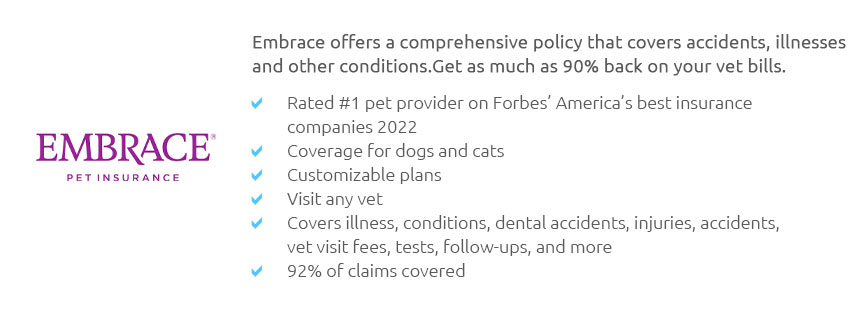

How Do Premiums and Deductibles Work?Understanding premiums and deductibles is crucial when selecting an insurance policy. The premium is the amount you pay regularly to maintain coverage, while the deductible is what you pay out-of-pocket before insurance kicks in. Balancing these two is key to finding a plan that fits your budget and your dog's needs. Are There Any Exclusions or Limitations?Yes, it's essential to read the fine print of any policy. Common exclusions include pre-existing conditions and certain breed-specific issues. Additionally, some policies impose limits on the amount they will pay out annually or per condition, so understanding these limitations is crucial. How to Choose the Right Insurance Plan?Selecting the right plan requires a careful assessment of your dog's specific needs and your financial situation. Consider factors such as your dog's age, breed, and existing health conditions. Research different insurers, compare their offerings, and read customer reviews to gauge satisfaction and reliability. Is Dog Health Insurance Worth It?This is perhaps the most debated question. For some, the peace of mind and financial security it offers is invaluable, while others may feel the premiums are not justified by the potential benefits. Ultimately, the decision hinges on your personal circumstances and your willingness to accept risk. In conclusion, health insurance for dogs is an option that merits consideration. By evaluating your pet's needs and thoroughly researching available policies, you can make an informed decision that ensures your beloved companion receives the care they deserve without breaking the bank. Remember, the goal is to strike a balance that provides both protection for your pet and peace of mind for you as an owner. https://www.metlifepetinsurance.com/

Pet health insurance reimburses you for covered costs on your vet bills helping you pay for your dog or cat's unexpected medical expenses. Take your pet to ... https://www.usaa.com/insurance/additional/pet

Pet insurance is a policy that helps give peace of mind to pet owners. If your furry family member needs an exam, procedure or medication because they're ... https://www.wishboneinsurance.com/

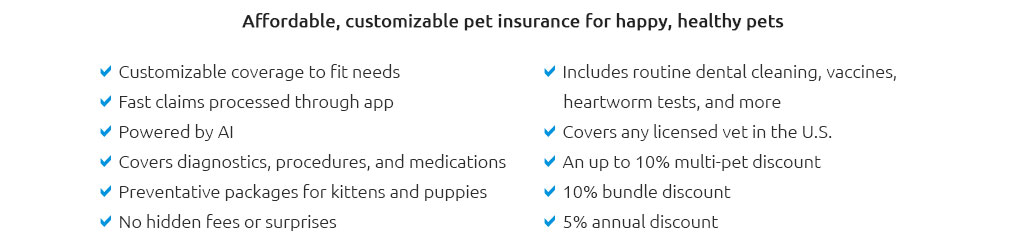

Wishbone's easy-to-understand pet health insurance makes getting reimbursed for your pet's veterinary care easy so you and your pet can enjoy a life well ...

|